Your current location is:Fxscam News > Exchange Traders

Mt Gox cryptocurrency exchange collapse triggers market panic, Bitcoin plummets

Fxscam News2025-07-23 06:04:00【Exchange Traders】0People have watched

IntroductionCCTV news Putun foreign exchange,I was cheated by mt4 Forex platform,Bitcoin plummeted in early Asian trading on Monday, reversing a slight weekend rebound and hitting a

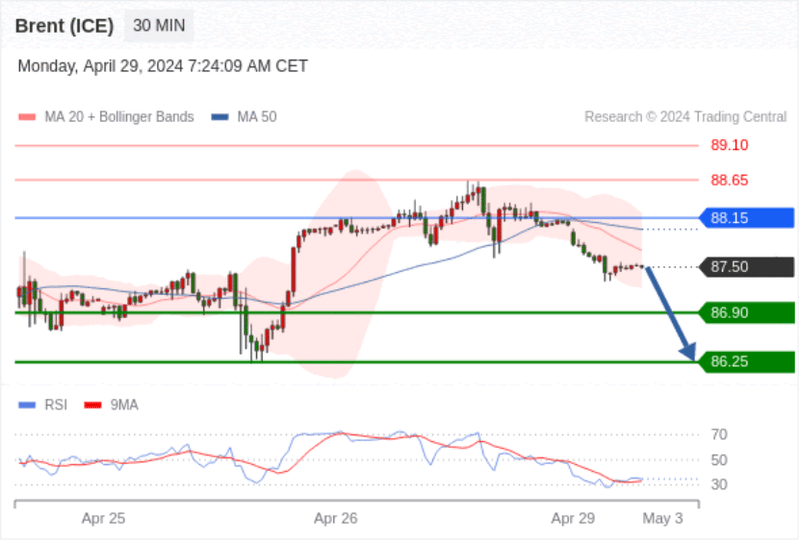

Bitcoin plummeted in early Asian trading on CCTV news Putun foreign exchangeMonday, reversing a slight weekend rebound and hitting a new low not seen in over four months, due to concerns that the defunct cryptocurrency exchange Mt Gox might release a large supply of tokens.

As of 21:28 Eastern Time (01:28 GMT), Bitcoin, the world's largest cryptocurrency, fell 5.8% in the past 24 hours to $54,601.7, nearing its lowest level since late February. Bitcoin also broke through the crucial $55,000 support level.

For the past two weeks, Bitcoin has been under enormous downward pressure due to market concerns over the distribution of Mt Gox tokens. Last week, the exchange's trustee announced they had begun distributing the tokens stolen in the 2014 hack to creditors via multiple exchanges, though they did not specify the number of tokens returned.

Earlier this year, it was discovered that wallets associated with the exchange had moved approximately $9 billion worth of Bitcoin.

Mt Gox has been a major point of contention in the cryptocurrency market, as traders speculate that given the substantial increase in Bitcoin's price over the past decade, creditors receiving the tokens might sell them on the open market, increasing the token supply.

Concerns over this situation have triggered widespread token sell-offs, with several Bitcoin "whale" wallets also activating and selling their holdings.

The Bitcoin sell-off has affected the broader cryptocurrency market, with Ethereum, the world's second-largest token, dropping 7.3% to a two-month low.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(95)

Related articles

- On 9/28: HKEX will launch its new IPO platform FINI on November 22.

- Bostic is expected to cut interest rates twice, weakening the dollar index.

- U.S. November CPI may affect Fed's rate cuts, with GBP/USD facing resistance.

- The US Dollar Index falls as foreign exchange market volatility intensifies.

- Market Insights: Jan 31st, 2024

- The US dollar retreated, the pound weakened, and non

- Trump's tariffs sparked volatility, with strong demand pushing 20

- Despite de

- AXEL PRIVATE MARKET Broker Review: High Risk (Illegal Business)

- The People's Bank of China issues offshore bills, signaling exchange rate stability.

Popular Articles

Webmaster recommended

Octa Forex Broker Review: High Risk (Suspected Scam)

BoJ rate hike expectations ease, yen rebounds above 150, focus shifts to December meeting.

Trump's tariffs sparked volatility, with strong demand pushing 20

South Korea declares a state of emergency, sending the won to a two

UK FCA Blacklists Eight Brokers in Latest Regulatory Update

Australia's unemployment dropped to 3.9% in November, highlighting labor market resilience.

The yen rose to a yearly high on growing rate hike expectations for the Bank of Japan.

Former BOJ Official: Trump Policies Add Uncertainty, Rate Hike May Be Delayed to March